Source: https://www.buyassociationgroup.com/en-gb/news/birmingham-economy-up/

I’ve been thinking a lot about Birmingham’s housing affordability pressures and the rent movements shaping the city’s property market. After 15 years leading urban development and investment portfolios, I’ve seen waves of optimism and frustration. The current phase feels different—rooted in structural change, not short-term spikes. What’s happening in Birmingham now will define its residential economics for the next decade.

Shifting Market Dynamics in Birmingham’s Housing

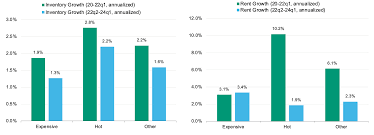

A few years ago, we assumed Birmingham’s housing affordability pressures would ease once supply kicked in. That didn’t quite happen. While cranes fill the skyline, the real picture beneath the numbers tells a story of uneven recovery. Rent movements show modest dips in the city centre but consistent climbs in commuter belts like Solihull and Sutton Coldfield.

In my experience, when housing costs rise faster than wages by even 3-4% annually, affordability tightens sharply. Birmingham is now facing that squeeze. The market’s optimistic tone hides a sobering truth: landlords face higher costs, but tenants shoulder the real burden.

The Role of Wage Growth and Living Costs

Housing affordability isn’t just about prices—it’s about income. Back in 2018, analysts believed wage growth would balance rent inflation, but in Birmingham, that narrative has fallen apart. Utility costs, council taxes, and everyday expenses have outpaced salary increments.

From a practical standpoint, real disposable income is falling, and that’s making the rental market less fluid. I once worked with a client managing a mid-size rental portfolio—rent renewals slowed because tenants simply couldn’t absorb new increases. The city’s average rent hike of around 6% last year only deepened that tension.

Investor Demand and Its Ripple Effect

When I first started advising property funds, we chased Birmingham for its yield stability. Now, institutional investors see it as a long play—but that comes with consequences. Investor appetite fuels development, yet contributes to housing affordability pressures when the supply mix leans upscale.

Here’s what nobody talks about: investor-led regeneration often upgrades neighborhoods faster than local incomes can keep up.

The result? Rent movements that benefit asset holders but alienate the workforce that sustains the local economy. Sustainable affordability requires aligning investment incentives with resident realities.

Policy Shifts and Urban Planning Challenges

Policy responses to Birmingham housing affordability pressures have been uneven. Local development frameworks look solid on paper but falter in execution. Take the “balanced communities” initiative—it aimed to integrate affordable units into new builds, yet loopholes and viability assessments diluted its impact.

During the last downturn, smart councils incentivized smaller developers who could deliver mixed-income projects faster. Birmingham could revisit that playbook. A measured approach—part zoning reform, part fiscal discipline—could curb the next phase of rent movements before they spiral into another affordability crisis.

What the Future Holds for Birmingham’s Renters

The reality is that Birmingham’s housing affordability pressures aren’t temporary—they’re cyclical. Every cycle refines how residents, investors, and policymakers interact. The data tells us young professionals are renting longer, delaying ownership not by choice but by constraint.

If we learned anything from the 2020s, it’s that housing equity gaps widen quietly before they explode publicly. To future-proof Birmingham, both the private sector and the local authority must anchor rent movements in sustainability. Short-term fixes won’t cut it anymore.

Conclusion

Birmingham’s housing affordability pressures and rent movements reveal more than numbers—they expose how we value community stability and economic growth. I’ve seen strategies fail because they ignored that human layer. The bottom line is, smart cities balance profit with inclusion. For Birmingham, the choices made in the next five years will define who gets to call it home.

FAQs

What are the main causes of Birmingham’s housing affordability pressures?

Birmingham’s affordability pressures stem from rising construction costs, investor-driven development, and minimal wage growth relative to rent increases.

How have rent movements changed in Birmingham recently?

Rent movements show moderate increases citywide, with the largest spikes in suburban areas where demand surpasses new housing supply.

Is Birmingham more expensive to rent than other UK cities?

Not yet, but it’s catching up fast. Birmingham rents have grown 5–7% annually, closing the gap with mid-tier London suburbs.

Why is wage growth not keeping up with housing costs?

Sectoral stagnation and inflation-adjusted earnings growth below 3% have eroded purchasing power, worsening affordability for renters.

How are developers responding to affordability pressures?

Some developers diversify portfolios with smaller units or co-living models, but luxury development still overshadows attainable housing supply.

What government measures affect rent movements?

Local councils set planning conditions, but national tax policies and mortgage rate changes indirectly influence rent adjustments.

Has the rental supply improved in central Birmingham?

Yes, but only for high-end units. Affordable or mid-tier rental stock has barely expanded despite ongoing construction.

How do investors view Birmingham’s housing market now?

Investors still see long-term potential but are cautious about regulatory shifts and rental yield compression in prime zones.

What sectors feel the impact of housing costs most acutely?

Healthcare, hospitality, and education sectors struggle as rising rents deter essential workers from living near their workplaces.

What can be done to stabilize Birmingham’s rent movements?

Stronger coordination between city planners, investors, and social housing schemes is crucial to balance rental demand and affordability.